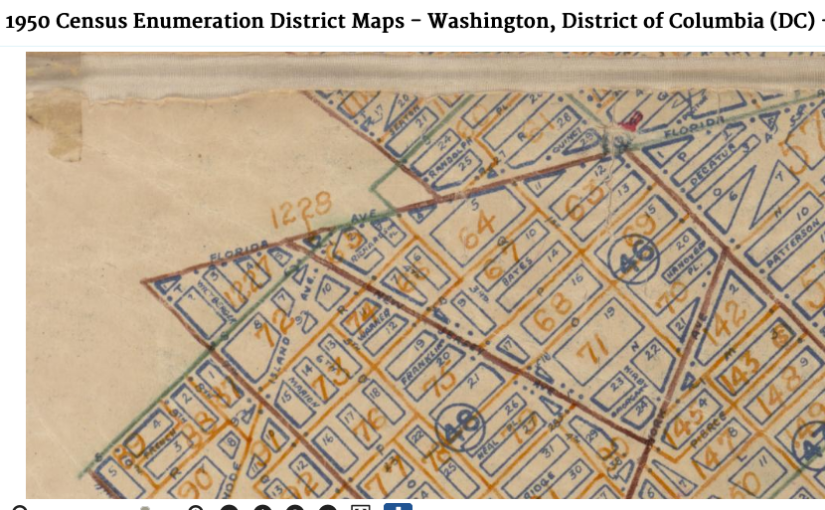

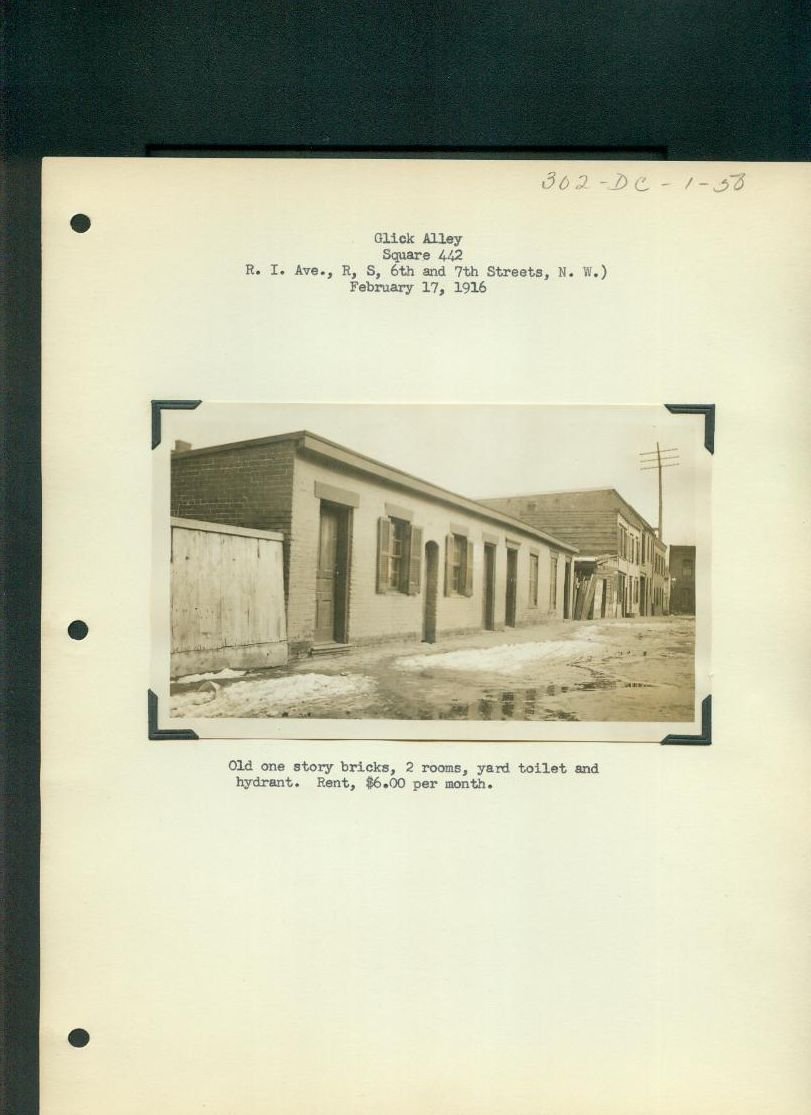

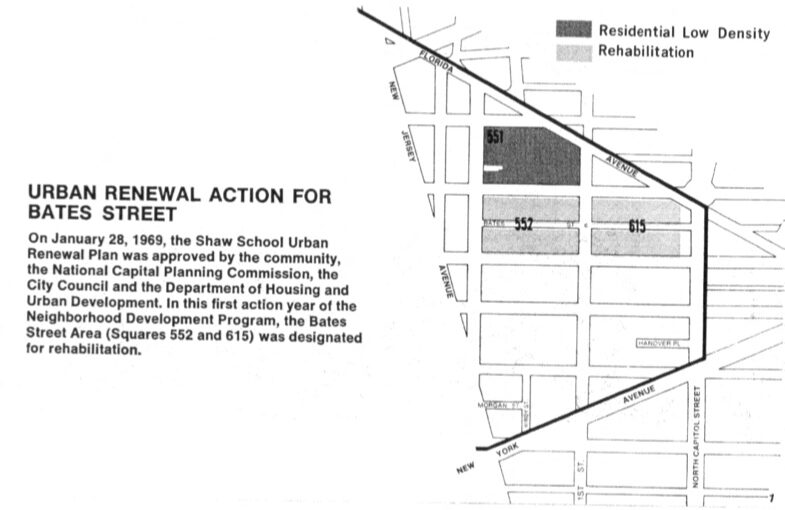

Normally this blog looks at African American home owners in the Black Homeowners of Truxton Circle series. As a way to see if what was going on for Black mortgagees was normal, or not, I am comparing them with white home owners. I am looking at blocks that were over 90% white in 1950 but also in the same “red lined” zone, which was F1.

Earlier we looked at Bessie and Matthew Woods who owned 517 Third St SE up until 1943. There was a period when Clarence Garber owned 517 3rd St SE Bessie, after the death of Matthew from 1939-1943.

The co-ownership seemed a little unusual and I tried to find a connection between between Laura Bessie Mae Moffatt-Davis-Woods-O’Donnell (thrice married) and Clarence Anthony Garber or his wife Buelah Mae Armentrout Garber. The connections were scant. Bessie was from Loudon County VA, the Garbers from Stauton, VA. They do not appear to be related. Nor were they neighbors during the 1920 nor the 1930 census.

Clarence A. Garber came to own the house in 1939. Let’s recap what happened from the Woods’ post:

Clarence A. Garber came to own the house in 1939. Let’s recap what happened from the Woods’ post:

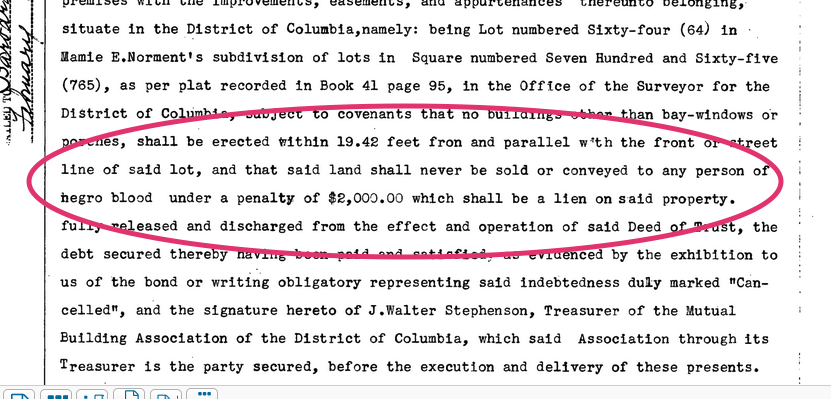

In 1939 there were a series a deeds. Documents 1939037405 and 1939037406 transferred the property from Matthew and Bessie Woods to Bessie Woods and Clarence A. Garber, via Edward J. Berdaus. In 1943 the property was transferred to George A. Brennan and there was a note that Bessie’s name changed to Bessie O’Donnell. The next document, #1943027651, transferred the property from Brennan to Clarence A. and his wife Beulah M. Garber.

Upon the removal of Bessie’s name from the property and Clarence and Beulah Garber being the sole owners, they got a loan. The day they both became owners, October 28, 1943, they borrowed $3500 from the Washington Loan and Trust Company. Their ownership ended when they sold the property to Levi Thomas Wellons Jr and his wife Frances on May 6, 1949.

The Garbers show up in the 1940 census. In 1940 Clarence was a 31 year old carpenter living with his wife Beulah, a stay at home mom to their 2 sons, Robert and Fred. They also had two lodgers, Catherine Uhrig and Bessie M Woods, not yet O’Donnell. Bessie was part owner of the house in 1940. The house is large enough to be 2 units with an English basement below.

The Garbers had family in the neighborhood. Clarence’s father, Anthony Garber (also a carpenter) lived over at 122 5th St SE. During the 1930 census, the newlyweds Clarence and Beulah lived there with newborn Robert, along with sisters Ruth & Pauline.

After selling 517 to the Wellons, who will be covered in another post, the Garbers bought 3025 24th St NE a few days later on May 10, 1949. They owned it until 1956. Clarence died in 1988 in Huntingtown, MD. Beulah died in 2000 and is buried in Prince George’s County Maryland.