Tell me what they will build there?

Tell me

Condo, Condo, Con-do!

Things cropping up everywhere,

Open house just tell me when.

-to the tune of Quando, Quando, Quando

So I have a bias against condos. Just for myself, not other people. If you have stayed in the same 1 mile or 1/2 mile area for 10 years, and are renting, you might want to consider buying a condo…. unless you can afford an actual house, where you own the bricks or board and the dirt beneath.

Unfortunately, condos are the most “affordable” things that are livable around here. Probably not these condos, considering Compass is involved. The Chapman Stables have some studio and 1 bedroom units in the $300K range. Yes, not including the condo fee, you’re paying a little over $2K, provided you put down a decent down payment for 1 room. No parking space. I think Chapman has 1 studio left for $333K. Should the owner of this fine unit ever decide to rent out their unit, because they fell in love, added another human to their life and needed more space, they would probably need to charge nearly $3K a month to break even (condo fee, property management, business license, etc).

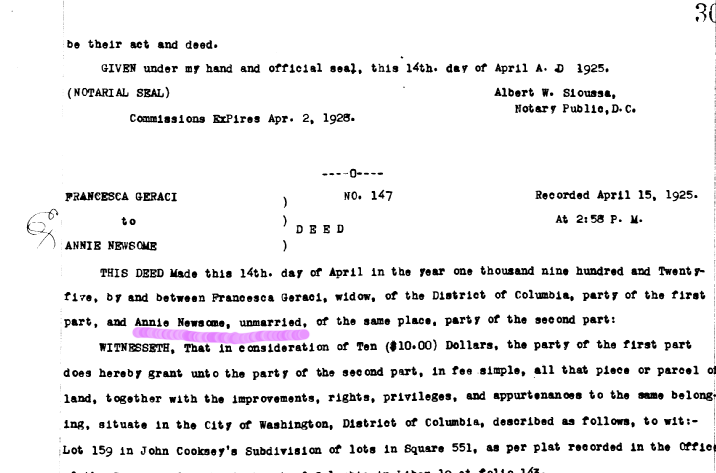

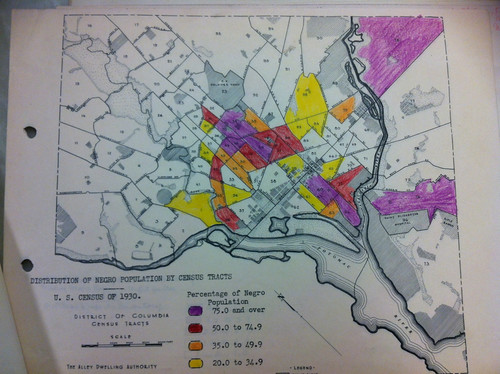

I’m not too distressed by the idea that large houses are being broken up into smaller condos. Many of the Truxton houses, the Wardman Flats, and the Bates Street houses were created as 2 unit flats. The value went down and some of them were turned into 1 unit homes. Now developers are turning them back into 2 unit properties. What goes up can go down. This neighborhood pretty much ignored the 2008 housing crash, but I can imagine something that would make those new 1 million dollar condos and houses near worthless. Not anytime soon, and hopefully, not in my lifetime, but a lot can happen in 100 or 50 years.