I had a job interview a few weeks ago, it went well, so well I seriously gave thought to what we would do if I was chosen for the position. You see, it is in the same suburban area of Maryland where my spouse, the Help works, and I said if I were to get a job there, we’d move. So for several days I was looking at moving to Maryland and all that would entail.

I had a job interview a few weeks ago, it went well, so well I seriously gave thought to what we would do if I was chosen for the position. You see, it is in the same suburban area of Maryland where my spouse, the Help works, and I said if I were to get a job there, we’d move. So for several days I was looking at moving to Maryland and all that would entail.

We already know what neighborhoods we want to live in on the other side of the border. Yes, this is something we think and talk about on a regular basis. But I hadn’t thought about the consequences of leaving Shaw and the city.

What we’d lose

Walkability

Our part of Shaw is a wonderfully compact. Within a 1/3 mile I can walk to the grocery store, a couple of bakeries, a bunch of restaurants and bars, the metro, and Destructo’s daycare. I haven’t owned a car for over twenty years and it’s been a couple of years since I’ve driven. I like being able to walk with Destructo or plop him in a stroller and walk to a park. When I looked at a few houses on-line that I thought was close enough to a metro station, PG Plaza was over a mile away, and a park well over 1/3 mile. Whereas our block has a WalkScore in the 90s the areas I was looking at had scores in the 30s… and no sidewalks.

Lower Property Taxes

When looking at possible homes in our price range, looking at the property taxes made some places just, unaffordable. A lovely little 3 bedroom in the $300-400K range had taxes above $5,000 a year. Our taxes in DC are somewhere just below $3K a year. A couple hundred dollars of our monthly mortgage goes to taxes and insurance, but I was seeing sizable $400-$700 a month going to taxes for PG Co. properties.

Free Pre-K

Dangit, I been paying into this system, I’m going to get my 2 free years. Destructo won’t enter the school system until 2020-21. If we were to move, we’d be paying for 2 more years of daycare since PG County doesn’t have free Pre-3-4K. That’s when I decided I’d rather have a bad commute (I’d worked at this location before) than pay $30,000+ for 2 years of daycare.

Loss of connections

Living here for nearly 20 years, despite people constantly moving, we’ve got some deep strong connections here. After observing others move to other nearby neighborhoods or over into suburbs, I know after a while you stop seeing those people. I wouldn’t expect us to be any different. We have friends and family in PG County and those connections would get stronger, but I would miss what I have built here in Shaw.

Other things I had to consider

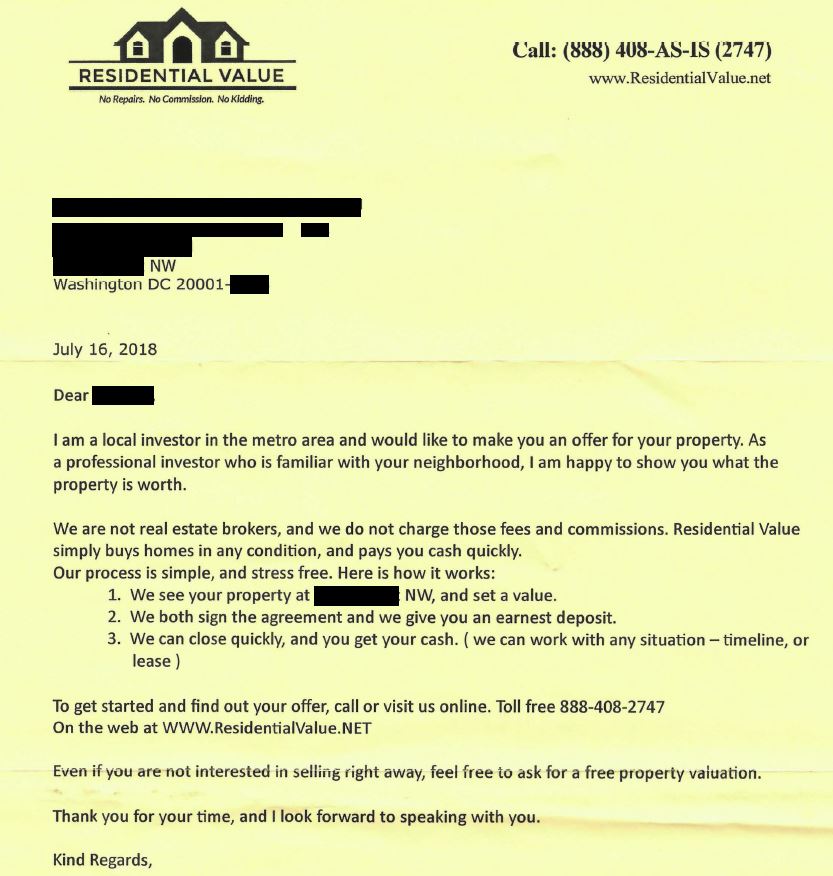

Sell/Rent house?

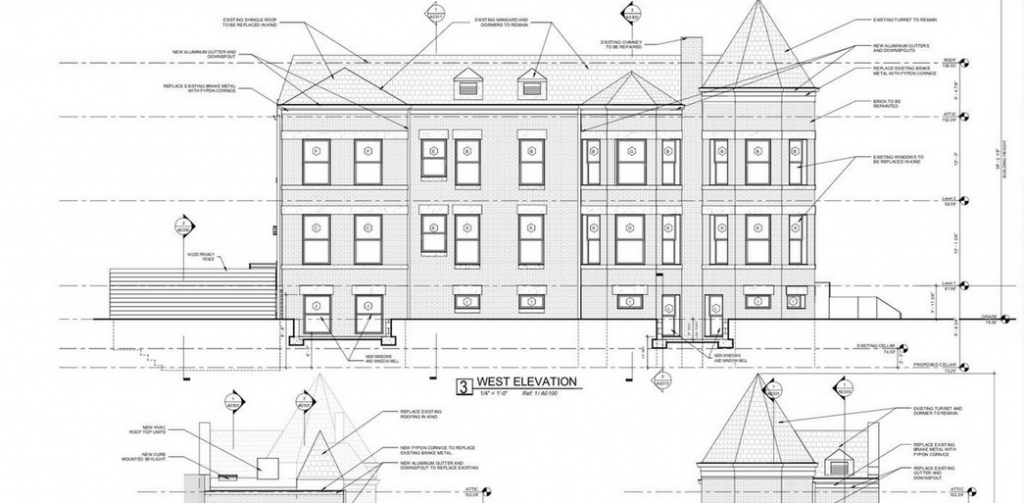

Then there is the question of selling or renting. I’m emotionally attached to this house I live in. It was my first property. I’m not sure I can just hand it over to some renter to make their mark on. However, renting would allow me to return to the TC if I manage to return to my current duty station if an opportunity arose. Also the rules about renting in this city seem to get more complicated, which would mean hiring a property manager. Some of my former neighbors self manage, other use a property manager. Question would be would I want to self manage my baby?

Then we’d have to make the house suitable for renters. When you own your own home, there are things you let slide. Our AC died 3 years ago. We’ve got portable and window units that work well. The bathrooms aren’t painted that well, because I painted the whole house myself and never ever got back to them. There is a whole long list of little repairs that should be done, but since the health of the house does not depend on those repairs getting done anytime this century, they don’t.

If I were to sell, the property tax issue I have such a problem with would be less of an issue, because the equity we have in our home would make some places mortgage free. I wouldn’t have to think about managing a DC property.

Mari InShaw to Mari N. Peagee?

A lot of my on-line identity is based on being in Shaw/Truxton Circle. Would I change it if I moved? I’m still pondering that one.

Recently, I found out I wasn’t chosen. I called one of the interviewers, who I knew professionally, regarding why I wasn’t and now I know what areas I need to improve. So when the next opportunity pops up I know what I will do, and if chosen, I have a plan.

Edited 12/11/19 to add Walkscore URL.