This was written in 2019 and sat in my drafts. I’ve edited a little bit.

There was a post sitting in my drafts called “Let’s Resegregate Shaw.” It was sitting there so I can get the sarcasm out of my system. Then a cooler head prevailed and I deleted it altogether.

The DC school lottery results have been out for a while which resulted in a fair number of education opinion and data reports. What bugs me is that it seems the authors don’t acknowledge the peculiarities of the District of Columbia and how whatevertheory they have that may apply to Anywhere, USA doesn’t necessarily work here.

Chocolate City and a Craptastic Education

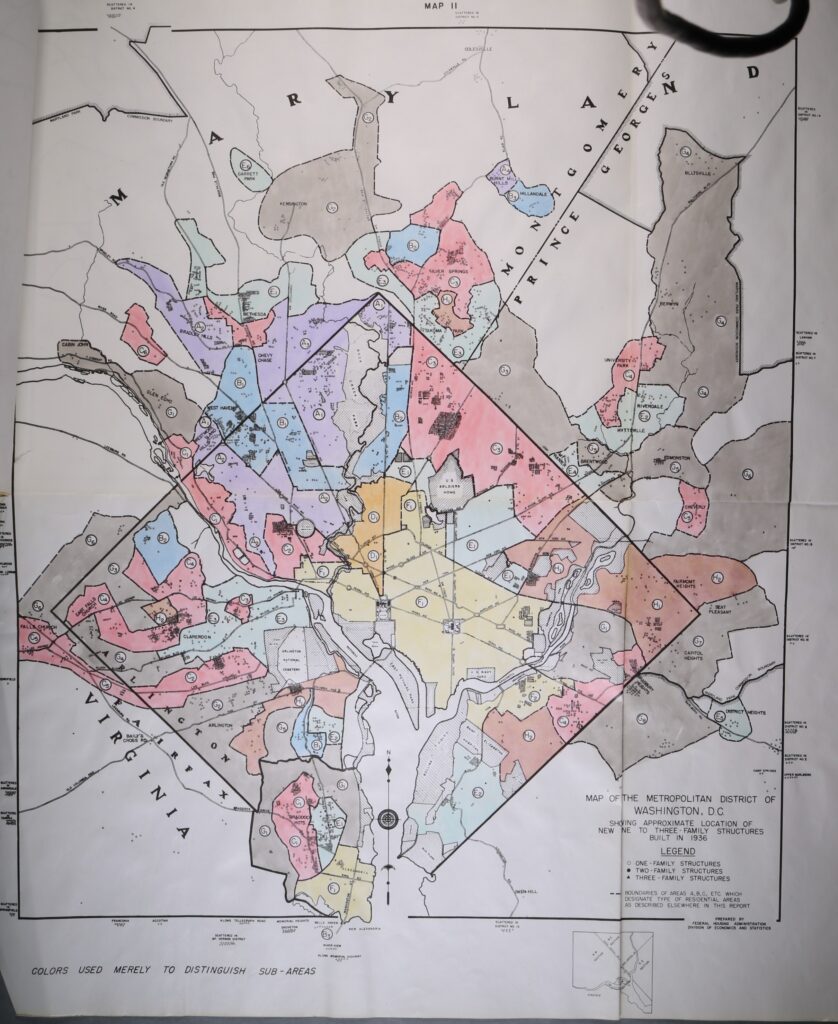

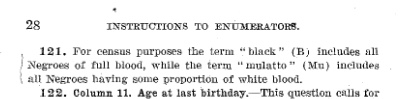

So after desegregation in District of Columbia schools after the Bolling v Sharpe case in the 50s, there was white flight (followed by black flight but we don’t talk about that..shhhh). The result was a overwhelmingly African American public school system, reflecting the majority minority city DC had become. In the last census, Blacks did not make up the majority, but was still the largest racial group in the city.

When I arrived in the DC area in the mid 1990s, DC schools had a poor reputation. The sign that everything, including the kitchen was being thrown at the problem was when General Julius W. Becton Jr., a man with no previous background in the field of Education, was named School Superintendent in 1996. DC had some of the highest per pupil spending but the worst outcomes. Gen. Becton resigned, quit, headed for the hills, after 16 months on the job. I don’t know when the public schools went downhill, all I know is it was broken when I got here.

Addendum from 2023:

It appeared to me when I wrote this that the schools were resegregating. I couldn’t help but notice that white parents who remained in the District of Columbia flocked to certain charter schools if they didn’t live west of the park (Rock Creek) where white students were the majority.

I did a review of Shaw schools in 2021 and with the exception of KIPP the academics of many of the public and charter schools were unimpressive. And, with the exception of charter school Munde Verde, they were pretty segregated, being majority Black with so few white students their PARCC scores hardly registered.

Children/ students are not the property or products of the state. Parents are making decisions and making the effort to put their children in this or that school. So there is a limit of what the DC government can do to attempt to integrate/desegregate DC schools. We may disagree with parents’ decisions to have their children sent halfway across the city to some random charter instead of their neighborhood public school. Or parents who purposefully moved into the Deal Middle School boundary area with crowding out other students from other areas and fighting any change in that boundary.