I was walking by three different vacant lots on my way to work. One is used as a parking lot occasionally, but for most days of the month lies vacant. The other lots are fenced in, and there are a few other lots I know of along alternative routes to the metro, also fenced in.

Anyway, I was thinking, it would be great if these lots were community gardens. About half of part of the lots get full sun. Even better a couple have southern exposure. A way to encourage this could be a reduced property tax rate for owners who lease green space to gardeners. In the city center, where there are more apartments, condos and townhomes with non-existent yards there is a demand for greenspace. If there was an environment that encouraged this sort of land use, it would be great.

Day: April 15, 2009

Death and Taxes

I was going to write up properties getting the Homestead or Senior Citizen Homestead deduction with owners names that are listed in the Social Security Death Index, but that was too much work. I didn’t get past 3 northern Truxton block before I got bored.

Instead I’m going to complain about the Senior Citizen Homestead deduction, two dead people and their real estate taxes. I don’t get it. One dead person, who has been dead for over 5 years, but who has been dutifully paying their real estate taxes is charged less than my aunt (alive) receiving the same deduction. Both properties have the same square footage, the dead person’s house doesn’t have AC. Auntie does have AC, one less bedroom and has a bigger yard. However, according to the City, Auntie’s house is worth $100K less than the dead person and the difference in taxable assessment is $80K. Even though being dead is worse, Auntie is blind and suffering from dementia.

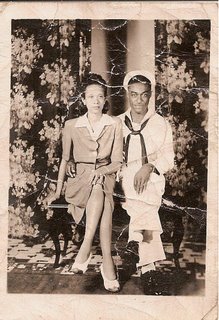

I said two dead people, one is our dead tax payer. The other is my late Uncle R, husband to blind Auntie. They are pictured here back when they were young. Sometime in the 1950s they bought a house in SE DC, and lived there. In the 1990s Uncle R died. Currently Auntie is listed as the owner and it is a logical assumption that previously the house was in Uncle R.’s name, if not both their names. Did that transfer or change in name bump up the taxable amount? Even thought my aunt has been living in the house for nearly 1/2 a century? As far as I can tell dead person in Truxton was there from the 1940s or sometime after the 1930 census.

They are pictured here back when they were young. Sometime in the 1950s they bought a house in SE DC, and lived there. In the 1990s Uncle R died. Currently Auntie is listed as the owner and it is a logical assumption that previously the house was in Uncle R.’s name, if not both their names. Did that transfer or change in name bump up the taxable amount? Even thought my aunt has been living in the house for nearly 1/2 a century? As far as I can tell dead person in Truxton was there from the 1940s or sometime after the 1930 census.

I can’t see why my demented blind widowed aunt pays more in real estate taxes than a dead person for a house worth less.