This weekend a house near me got under contract, despite the price. Honestly, I thought $599K was too much, considering a house on the same block with a similar layout, but with a basement and a somewhat functional gas fireplace sold for about $150K less. Others who’d seen the interior of the higher priced home had said it was in move in condition and done very nicely. I saw the inside and admittedly couldn’t play the IKEA/Home Depot game, but I swear one of the interior paint colors was the same as my dining room’s. Ralph Lauren, Stony Mountain, NA15.

Well I gather the Real Estate market in the circle of Truxton, is healthy. That or someone really wants to live on our street. Maybe I’ll go with the second theory as Sunday was nice out, which meant the cute 5 and under set were out riding their bikes and razors. “Hey look, if you had kids they’d be playing with these kids by now.” And the people with dogs chatting with the neighbors doing things in their yards. For a while it was the best advertisement. A living brochure. A clean block (cleaned earlier that day by a neighbor) with happy children, a diverse (age & race) set of friendly looking adults being all frigging neighborly, smiling, laughing. That’s worth about $150K right there.

So putting your house on the market anytime soon? Somehow pick the nicest day for an open house and during the open house, convince your neighbors to make your block look like it’s fricking Sesame Street. Guaranteed sale.

Tag: Real Estate

ex-Shiloh Property under some renovation

PoP reports here, with a hopeful picture that work is being done on this former Shiloh Baptist property. If I have the address right (1600 8th St NW?) the property was sold 12/30/2009, so if the new owner is starting now, three months later, the future is lookin’ good.

Taxes

Let’s get personal at first, then we’ll get real.

In my general tradition I have finished my personal federal and DC taxes in the last week of February. I sort of did my federal taxes during the blizzard of 2010, but as always, there are forms and papers that trickle in the mail reminding me of donations and income I’ve completely forgotten about. But once you’ve done your federal taxes you can file your DC individual taxes on-line, for free. To do so you will need your federal Adjusted Gross Income (AGI) you entered on your 2008 DC tax return (form D-40EZ, line 3 or form D-40, line 3). If you didn’t file last year in DC then you can’t use the on-line feature. A quick review of my taxes (I used H&R Block’s software) shows that I could have donated more to charity, and put more in my retirement plan.

My biggest tax break came from real estate. I paid somewhere around 11K or 13K in mortgage interest, which knocked about 2K off in personal taxes. Maybe I can use that savings to make up for the noticeable jump in real estate taxes levied by the District.

If you haven’t got your assessment, be prepared. You know that 10% cap? Yeah, forget about it. There’s now a minimum tax floor, 40% of the assessed value of the home. Not even the senior citizens’ are safe. I noticed they’re getting hit with the same floor, so not so great news for granny. But on the plus side, it does make some problem houses have an incentive to sell.

My own feelings about it are mixed. I liked having a lower tax rate because I bought before the RE boom but at the same time the low tax was like a pair of golden shackles. The tax was a great incentive not to even think of moving. But as certain things in my life change, and I can anticipate that my housing needs may change, making the tax difference from one house to another a minor factor, frees me up to ponder living elsewhere, even if that elsewhere is down the block or off in PG.

And for a millyeon dollas this can be yours

Fooling around on Redfin I spotted a few houses east of Logan Circle going for $1 million and up. What is this Southern California?

First is a penthouse condo on R Street near Logan for $1.05 mil. It comes with parking and a condo fee.

Next is, 1114 P St NW, going for 1.15 mil and on the market for over 200 days, plus a month. I gather the $71K gross rental income justifies the price, for the three unit property.

There are a few more million plus places hugging the Logan Circle, but priced above them is closer to me, is 1400 5th St NW, for S1.399 mil. I gather that the idea that one could turn the three unit building into 5 units is justification for the price. However, there is no parking, it isn’t next to any amenities and more work will have to go into it, as “potential” means “gut job”.

Lastly, topping off at 1.45 mil is 1120 Rhode Island Ave, NW. A single family home boasting of a lot of original features. The city thinks it’s worth 1.298 million, so the taxes are about $11K a year.

Death, taxes and the assessment cap

Once again I was poking around seeing what my assessed value was, not that it matters. Those of us who bought our homes before houses were too expensive, have these lovely golden handcuffs in the combo dish of the Assessment Cap Credit, and the Homestead Deduction. That means that people who have been in their homes a long time (and bothered to get the homestead deduction) pay a couple or several hundred dollars a year in property taxes, as opposed to newer folks who pay a thousand to several thousands a year. I say the combo of those tax credits are golden handcuffs because the low tax, is a great incentive to not move. It is a good program, in that it encourages neighborhood stability. It allows long term owners to stay in their homes despite the rise in home prices around them. Provided they bothered to get the homestead deduction in the first place. There are neighbors who I know are living in their homes but don’t have the homestead deduction and are paying the full price in taxes and aren’t protected by the 10% cap.

I was poking around on the Tax Office’s real estate assessment database because a few months back I got a visit (wasn’t home so I called him) from the tax assessor who wanted to know if I made changes. I did, but it seems none of them really matter tax wise. Curiously, being what it is I checked out the assessments of other properties in the area. What owners are taxed at varies, depending on if they are residents or landlords, when they bought, if they are senior citizens or low income, etc. But then I’d see an exceptionally low taxable assessment value in the 10K-20K range, for a small number of owners who bought in the aughts. Not complaining, just observing.

What I will complain about are the dead people paying low property taxes. Mainly because said dead persons are getting the Senior Citizen Homestead Deduction, which means they are paying super low taxes, which is fine if you’re old and typically on a fixed income. However, grammy dies and the kids continue to pay the low tax. This is fine for the first couple of years after a death because of probate and clearing up the estate, which I understand is no easy task. However after say 3 years, the new owners (widow/widower or kids) need to be listed and taxed appropriately. Flipping around on the database there are still a few dead people in the hood paying taxes, according to the Social Security Death Index, which the Office of Tax and Revenue doesn’t seem to bother to check.

Sibling Rivalry & Slumlording All In One

I’ve been debating about if I should post this bit of family business on the blog. Everyso often I might mention my sister and my nieces, one of whom is my blog icon. But so I’m not explaining the story over and over, as I have forgotten who I’ve told and when and how much, I’m going to try here.

Shaw has a fair amount of subsidized housing, it is the thing that keeps the neighborhood economically diverse, which is good. However, I don’t believe subsidized housing is a good long term solution for individual families. At least not my family. It’s fine for seniors, as we do need to care for our elderly, but for young families with developing children, no. Not long term. My sister and her husband and her daughters (my nieces) live in subsidized housing in Florida, and finally G-d has provided the means for me to get them out of there.

My sister’s family live in a run down apartment complex. Earlier this year the local paper announced that the conditions were so bad that HUD was going to revoke federal funding for that and another complex. From my own visits I observed poorly maintained parking lots with tons of pot holes, and a blue tarp covering the roof that had been there for a while.

Also going on is the Real Estate troubles which have hit Florida really hard. Poking around on-line I discovered a house near my mother’s house for $7,500. Yes, $7,500 for a stick structure and a little plot of land. But the stick structure needed lots of work and in inquiring about it I hooked up with a Realtor. Bob, the Realtor worked with my Mom and my sister and found us a foreclosure that was clean and in almost move in condition for well under $40K. However, I’ve had to destroy all my savings and investments to make it happen. So there is some good in the foreclosure crisis.

So once I get some minor repairs done (some leaks, a hole in the wall, etc), figure out how to hook up the utilities, and get her to sign the lease, I will be my sister’s landlord. She and the family will move to a working/middle class and diverse neighborhood. And if she can manage not to stiff me for the rent (taxes & insurance mainly), she will be able to buy the house at a discounted price after a number of years. Which is fair since she’s in charge of all the maintenance. This moves my nieces out of an area of concentrated poverty and into an environment where they can be free to run in their own yard. The yard also give my BIL a place to garden.

This is not charity, it’s taking care of family and an opportunity to live out my beliefs. As a society we should take care of the least fortunate, but we should also encourage them to become strong and independent so they on an individual level can help others as well. I see independence as freedom, and everyone should be free.

I want to thank my roommate whose help has been invaluable as she drove me to the inconvenient bank and the other places I needed to get to. And I need to thank my supervisor, who let me leave work with a moment’s notice to deal with this.

So I’m going to put the blog in sleep mode while I take care of my new house, so the comments are in moderated mode. I’ll be back to the blog in a week or so.

Housing Dirt

Yesterday I was looking at my rear kitchen wall which has some fairly new and widening cracks (ah the joys of home ownership). Because of some funky fencing, part of my wall is on my neighbor’s side of the fence. So I went over to his place and took a look at the part of the wall I couldn’t see from my side of the fence. While I was over on his side chatting with him I did mention some of the dirt some of the other neighbors were saying about the construction quality of his place. From what I can remember the guys said that the contractor didn’t make the foundation for the addition deep enough and the addition violated the 60-40 rule.

I’m glad I mentioned it as I felt bad about warning/ telling him early on as a buyer. But really how do you which people are actually going to buy the house?

And yesterday I got an email asking about a house, that is up for sale. The email wanted to know about the neighborhood and the street and so on, but the description of the house was close enough to a house I know that more than likely has some serious structural issues. So let me say if you’re thinking of buying a house on the 100-200 block of Q Street, check the roof structure. If you or your home inspector can’t see the roof joists, don’t buy unless you are prepared to replace the whole roof.

Carter G Woodson, and a broke agency

Yesterday was a nice activity filled day. Did some gardening in the morning. In the afternoon got some dancing in at the Afro-American Civil War Memorial as part of DCLX. Lastly there was a meetup with Del. Eleanor Holmes Norton and some other local bloggers. My hearing is bad because of the background noise at the coffee shop I didn’t make out all that she said.

A topic of interest was the National Park Service and parks. Park-parks, with open space and stuff. However I asked about the NPS and the Carter G. Woodson house on 9th St. The short answer was the NPS did well enough to get the money to buy the Woodson house and the adjoining houses. They don’t have any money to do anything else.

Death and Taxes

I was going to write up properties getting the Homestead or Senior Citizen Homestead deduction with owners names that are listed in the Social Security Death Index, but that was too much work. I didn’t get past 3 northern Truxton block before I got bored.

Instead I’m going to complain about the Senior Citizen Homestead deduction, two dead people and their real estate taxes. I don’t get it. One dead person, who has been dead for over 5 years, but who has been dutifully paying their real estate taxes is charged less than my aunt (alive) receiving the same deduction. Both properties have the same square footage, the dead person’s house doesn’t have AC. Auntie does have AC, one less bedroom and has a bigger yard. However, according to the City, Auntie’s house is worth $100K less than the dead person and the difference in taxable assessment is $80K. Even though being dead is worse, Auntie is blind and suffering from dementia.

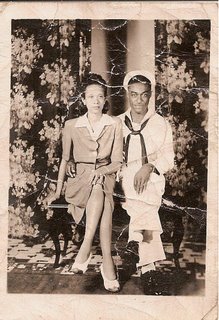

I said two dead people, one is our dead tax payer. The other is my late Uncle R, husband to blind Auntie. They are pictured here back when they were young. Sometime in the 1950s they bought a house in SE DC, and lived there. In the 1990s Uncle R died. Currently Auntie is listed as the owner and it is a logical assumption that previously the house was in Uncle R.’s name, if not both their names. Did that transfer or change in name bump up the taxable amount? Even thought my aunt has been living in the house for nearly 1/2 a century? As far as I can tell dead person in Truxton was there from the 1940s or sometime after the 1930 census.

They are pictured here back when they were young. Sometime in the 1950s they bought a house in SE DC, and lived there. In the 1990s Uncle R died. Currently Auntie is listed as the owner and it is a logical assumption that previously the house was in Uncle R.’s name, if not both their names. Did that transfer or change in name bump up the taxable amount? Even thought my aunt has been living in the house for nearly 1/2 a century? As far as I can tell dead person in Truxton was there from the 1940s or sometime after the 1930 census.

I can’t see why my demented blind widowed aunt pays more in real estate taxes than a dead person for a house worth less.

Real Estate TMI

Georgetown Metropolitan said it best, “sort of creepy”. The site is called Block Shopper. On one level it is good to know how many hands a property that’s up for sale went through since 2001. However, when it gets down to Technology Engineer Bob Brown sells Dupont Circle house for $899,088, that’s too much information. Seriously, too much.

Also (I just noticed) they STOLE, STOLE, as in not attributing or crediting, my Flickr pix. A few weeks ago I got on the case about this with the owner of one 4th Street house who used my picture of his house (and the neighboring houses) to advertise it as a rental. Hey-zeus Christie people, I don’t want money but I do want to be asked or acknowledged. Yes, someone’s getting a terse email.