I’ve complained about my dead aunt paying property tax before. I’ve even reported it to the DC Office of Tax and Revenue in 2016 and nothing, so I’m going to treat it like a very open secret, and assume DC government doesn’t give a rat’s rear end.

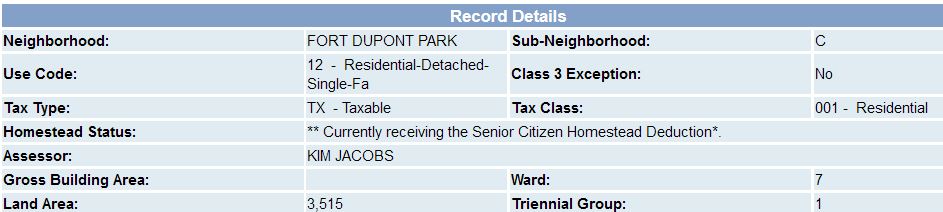

My great Aunt Geraldine died in February of 2012, she was over 100 years old. Prior to her death she was in a nursing home somewhere in Maryland. Her estate, which is a side of family I’m not familiar with, has been paying the property taxes. That’s fine except, they’ve been paying at the hugely reduced Senior Homestead Deduction.

Forgive me, math is not my strength, but without any deduction she’d be paying $2368.09 annually. Her estate and not my dead aunt, because being dead she’s not doing much these days, has been paying $685.82 annually. Roughly that’s a 60% discount.

The Senior Citizen Homestead Deduction is one hell of a discount. So when you encounter someone who 65 years old or older and or disabled who is a homeowner complaining about property taxes being too high, ask if they are receiving the deduction. Of course they could be receiving the deduction and still complain, as old people are wont to do. You could also look their house up on the DC Property Tax Database to check if they are receiving the deduction.

It is such a great deduction that estates, like my Aunt Geraldine’s estate, has no incentive to transfer the property into the names of younger hands. It is also a problem for vacant properties where the owner is dead.